Headwinds Are Rising, But the Canadian Economy Continues to Perform

An energy shock, a slowing real estate market, falling stock prices, inflation, rising interest rates—it all adds up to an increasing risk of recession in Canada. While we do expect economic activity to slow down in the face of these headwinds, we are not talking about a recession this year.

Has GDP Already Started to Decline?

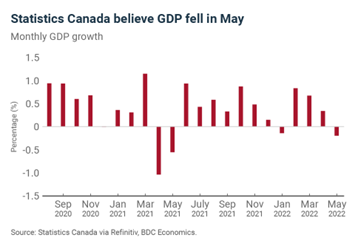

Economic activity in Canada continued to expand in April with monthly growth of 0.3%. However, according to Statistics Canada's first estimates, the economy contracted in May by -0.2%.

This anticipated slowdown would have mainly been in the mining, oil and gas, manufacturing and construction sectors. However, Statistics Canada’s preliminary estimates, which have only been published since the start of the pandemic, tend to underestimate the final results.

The Bank of Canada has not been deterred by this anticipated downturn, as evidenced by a significant 100 basis-point increase in its policy rate announced on July 13. Inflation hit a new 40-year high in May at 7.7%, another sign the economy is still running too hot.

Still Room for Growth

Despite the rate hikes to combat Canada's spiralling inflation, businesses continue to see strong demand.

Demand is being supported by a still buoyant job market in the country that continues to drive household spending. Workers are taking advantage of a tight labour market, with over one million job vacancies in the country as of April and an unemployment rate at 4.9% a new record low. The situation is increasingly reflected in wage gains (+5.2% in one year).

The increase in incomes combined with the still significant savings put aside during the pandemic are softening the blow of inflation for many households.

Supply Chains Improving, But Risks Remain

After months of dealing with unpredictable delivery times and persistent shortages, business leaders are finally seeing the first signs of improvement in supply chains. China continues to ease its harsh COVID lockdowns and container prices have begun to descend, a sign that container supply and demand is quietly rebalancing.

The situation is improving, but it’s still too early to claim victory since several factors are likely to aggravate the situation once again. The leading threat is China insistence on maintaining a zero-tolerance policy towards COVID outbreaks. A large part of its population is still not adequately vaccinated.

The Housing Market Hits a Speed Bump

Rising interest rates are already impacting the housing sector. Home sales were down 9% in May compared to April and overall real estate sector output in April was down 0.8%. That’s the second straight monthly decline and the worst result for the industry since April 2020.

The housing sector represents about 13% of the economy and this poor performance subtracted 0.1% from GDP. With the Bank of Canada raising rates sharply, activity in the sector is expected to continue to falter in the coming months.

Rate hikes are also hurting the financial sector. As capital markets cool, the sector lost 0.7% of its GDP from March.

https://www.bdc.ca/en/articles-tools/entrepreneur-toolkit/publications/monthly-economic-letter/2207#onglets=1